Understanding Full Coverage Auto Insurance: What It Is and Why It Matters

Talking about the way to safeguarding your vehicle, full coverage auto insurance is often considered the gold standard. Whether you’re a new driver or a seasoned motorist, understanding what full coverage really means and how it protects you can make a huge difference in your financial security and peace of mind. Now we are going to talk further about this type of insurance.

What Is Full Coverage Auto Insurance?

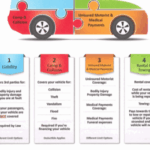

Despite the name, “full coverage” is not a specific type of insurance policy offered by companies. Rather, it refers to a combination of several types of coverage that together provide more comprehensive protection than the minimum required by law. Typically, a Full Coverage Auto Insurance policy includes:

Liability Coverage: Covers damage or injury you cause to others in an accident.

Collision Coverage: Pays for damage to your own vehicle after a collision, regardless of fault.

Uninsured/Underinsured Motorist Coverage: Protects you if you’re hit by a driver who doesn’t have insurance or lacks sufficient coverage.

Medical Payments or Personal Injury Protection (PIP): Helps cover medical expenses for you and your passengers after an accident.

Comprehensive Coverage: Covers non-collision-related incidents such as theft, vandalism, fire, natural disasters, and hitting an animal.

Benefits of Having Full Coverage Auto Insurance

Selecting full coverage auto insurance offers a wide array of advantages, especially for those with newer or financed vehicles. Here are some of the primary benefits:

1. Enhanced Financial Protection

If your car is damaged in an accident, stolen, or affected by weather events, full coverage helps you recover financially without bearing the full brunt of repair or replacement costs.

2. Coverage for All Types of Situations

From fender-benders to falling tree branches, full coverage provides peace of mind knowing you’re protected from a variety of unexpected events.

3. Lender Requirements

If you’re financing or leasing a car, your lender will often require full coverage to protect their investment.

4. Rental Reimbursement and Roadside Assistance

Many full coverage policies allow you to add features like rental car reimbursement and 24/7 roadside assistance, making life easier if your car is out of commission.

Top Auto Insurance Companies Offering Full Coverage

Most major insurance companies offer the components that make up full coverage car insurance. Here are some of the best-known providers you might be interested :

1. GEICO

GEICO is widely recognized for its competitive pricing and user-friendly digital tools. Their full coverage policies include standard protections, and they offer optional features like mechanical breakdown insurance and emergency roadside assistance. GEICO’s mobile app and online platform make policy management convenient for tech-savvy customers.

Average Annual Premium for Full Coverage : $2,031

2. Progressive

Progressive is known for its customizable policies and innovative tools like the “Name Your Price” feature, allowing customers to tailor coverage to their budget. Their full coverage includes liability, collision, and comprehensive insurance, with optional add-ons such as gap insurance and accident forgiveness. Progressive’s Snapshot program monitors driving habits to potentially lower premiums for safe drivers.

Average Annual Premium for Full Coverage: $2,133

3. Allstate

Allstate offers comprehensive full coverage policies with unique features like the Drivewise program, which rewards safe driving, and the Milewise program, a pay-per-mile insurance option. Their policies can include new car replacement and accident forgiveness. While Allstate’s premiums are higher than some competitors, many customers value their extensive coverage options and customer service.

Average Annual Premium for Full Coverage: $2,954

So from many types of full coverage auto insurance above, which providers you want to select for yours?