Protecting Your Ride: A Closer Look at Liberty Mutual Car Insurance

For protecting your car, choosing the right provider is as important as selecting the right coverage. Liberty Mutual car insurance has been a trusted name in the insurance industry for over a century. Founded in 1912, Liberty Mutual has built a solid reputation for reliability, customer care, and financial strength. With an “A” (Excellent) rating from A.M. Best Company, Liberty Mutual gives policyholders peace of mind knowing their insurer has the financial resources to pay claims when needed most.

But what exactly does Liberty Mutual offer in terms of coverage, and why should drivers consider this company over others? Let’s explore your coverage options, why Liberty Mutual stands out, what’s and the potential savings you could enjoy.

What Are My Coverage Options at Liberty Mutual?

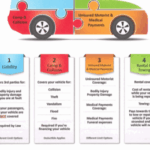

Liberty Mutual auto insurance provides a complete range of car insurance coverage options, each designed to protect different aspects of your driving life. Here are the core components:

1. Collision Coverage

Collision insurance steps in when your car is damaged in an accident, whether it involves another vehicle or an object like a tree or guardrail. Regardless of who is at fault, Liberty Mutual’s collision coverage helps pay for repair or replacement.

2. Comprehensive Coverage

This covers damage to your car that isn’t caused by a collision. Think events like theft, vandalism, fire, natural disasters, or hitting an animal. If your vehicle is broken into or damaged by hail, comprehensive coverage ensures you’re not left paying out of pocket for repairs.

3. Personal Injury Protection (PIP)

Sometimes called “no-fault insurance,” PIP covers medical expenses for you and your passengers, regardless of who was responsible for the accident. This includes hospital bills, lost wages, and even essential services like childcare if your injuries prevent you from working.

4. Property Damage Liability

If you’re found responsible for damaging another person’s property with your car—typically another vehicle—this coverage helps pay for repair or replacement. It can also cover structures like fences or buildings.

5. Bodily Injury Liability

This critical coverage helps pay for the medical costs, legal fees, and lost wages of others if you’re found at fault in an accident. It’s not just about financial protection—it’s also required by law in most states.

Liberty Mutual car insurance also offers optional add-ons like roadside assistance, rental car reimbursement, and new car replacement, which can further customize your policy to meet your needs.

Reasons Why Choose Liberty Mutual for Car Insurance

With so many insurers to choose from, Liberty Mutual continues to stand out for several compelling reasons:

Proven Financial Strength

Liberty Mutual holds an “A” (Excellent) financial strength rating from A.M. Best Company. This means they have a solid history of meeting their financial obligations, including claim payouts.

For over 100 years, Liberty Mutual has been committed to helping people protect what they love. Their longevity in the industry reflects a long-standing dedication to customer satisfaction and service quality.

Substantial Savings

Savings matter—and Liberty Mutual delivers. You could save over $950 by bundling your auto and home insurance with them. Beyond bundling, Liberty Mutual offers various discounts, including multi-car discounts, good student discounts, safe driver discounts, paperless policy savings and also pay-in-full incentives.

In the other hand, liberty mutual takes a personalized approach to coverage. Their right trackprogram, for instance, monitors driving habits and can reward safe drivers with significant savings.

So once you know about many benefit of having Liberty Mutual car insurance, are you ready to using this kind of insurance?