chip key programming Houston, TX

Our car key programmer will help make this process painless because they can work on getting your device programmed for you. In a minute, after you call, we will contact the locksmith in your area and get him to come to your location in a rush. We will go wherever our customers need us because we have a reliable roadside assistance.

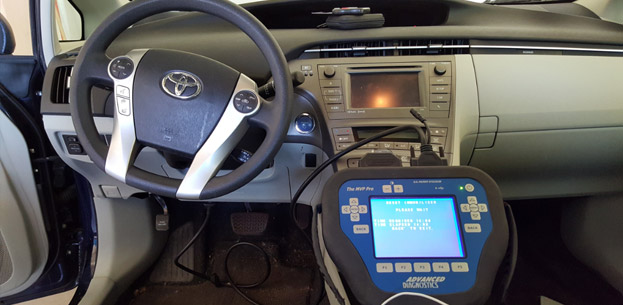

If you need chip key programming Houston, TX to help you, we are only a phone call away. We will arrive in a fully fitted service truck that has all the equipment we need to do our job. Why worry about a lost remote. Trust our locksmiths to get you another one.

When our key fob programming Houston, Texas team arrives, they will work on your vehicle no matter what you drive. If you own a Japanese, American or European vehicle we can work on that too. Our Roadside Assistance works around the clock.